What will 2026 be like?

OLYMPUS DIGITAL CAMERA

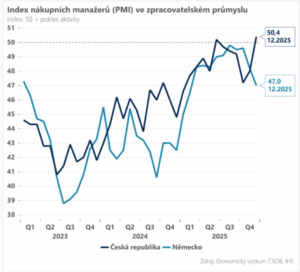

Probably the right question, but the answer will not be easy. If we use the PMI index, we have swung over 50 after a long time, but it is clear that Germany is still in recession, and this is not good news.

“Macroeconomic data show that the outlook for the Czech economy for 2026 is traditionally associated with a number of significant macroeconomic risks and uncertainties that may affect the development of the Czech economy in both directions, i.e. positively and negatively. The biggest uncertainty remains external demand, especially from the euro area, whose slowing growth could negatively affect Czech exports and investment activity of companies (Michal Stupavský, CFA, Investment Strategist, Conseq)”.

The big battle begins over energy prices. In Germany, they decided to subsidize the price of energy with CZK 782 billion. In our country, the state takes over POZE, i.e. payments for supported energy sources. This will make electricity cheaper by 10%. But it is a great stew when, on the one hand, a non-market price of energy is created, caused by the way energy is traded on the stock exchange, emission allowances, and subsidies for consumers are then introduced from its yield. But because each country in the EU chooses its own rules, then the competition begins to see who will redistribute more in order to gain a competitive advantage. You really can’t make that up. …

So what can we expect?

As far as the automotive sector is concerned, it is not a disaster so far. Škoda is running at full power, and Toyota has promised an investment in Cologne of USD 792 million to rearm to fully electric cars. I’m not sure about Hyundai, but even here part of the race should be rebuilt to batteries.

Even if Škoda ends the production of MQ200 manual transmissions, it will be replaced by an investment in full e-transformation. As VW’s management declares, “Škoda Auto’s future is electric, and we are committed to investing €5.6 billion in electromobility and €700 million in digitalisation by 2027. In addition to the recently unveiled production of the new generation Enyaq, a new electric large family SUV based on the VISION 7S concept car will also be produced in Mladá Boleslav”.

That sounds good.

Worse, however, there will be fewer parts for transmissions, for internal combustion engines, but they will be replaced by parts associated with new EV platforms, line automation, jigs, and mold production. However, there is also some hope for GIGA casting, but this is not yet certain today.

The same applies to Toyota and Hyundai. Therefore, a continued decline in the requirements for classic quenching and carburizing can be expected. In the case of Škoda-Auto, it is not so tragic for commercial hardening plants, Škoda does everything in-house, after all, other carmakers have a similar situation.

The global numbers for Czech GDP will therefore be good, but it can also be a disaster for custom hardening plants. The prize would be hybrids, HEV or even PHEV, but then it would look completely different. However, the displacement of the production of spare parts for these discarded gearboxes or engines could also be a win, because even here there is still an obligation to provide them for 10 years after the model has been discontinued.

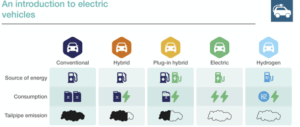

To make sure you understand this, I would like to remind you:

- ICE – Internal Combustion Engine

- HEV – Hybrid Electric Vehicle (classic engine + additional electric motor to cover peak performance, e.g. Subaru Hybrid, Toyota Hybrid, with a range of up to 5 km)

- PHEV – Plug-in Hybrid Elctric Vehicle (Classic engine and electric motor with full power, with a range of up to 70 km)

- BEV – Battery Electric Vehicle

- FCEV – Fuel Cell Electric Vehicle (A full-power electric motor with energy supplied from a hydrogen fuel cell, generating a source of electrical energy for the electric motor).

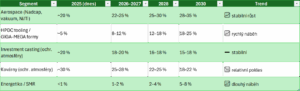

So if there are any expectations, it will be aircraft production, the production of jet engines for aircraft or for the military industry, the production of equipment (combustion turbines) for the power industry, or maybe even SMRs, small modular reactors with a lot of components. Here, annual growth of up to 5% by 2030 can be expected. But there are not so many manufacturers in our country, you can count them on the fingers of one hand. However, there is some hope, not yet confirmed anywhere, that the production of aviation equipment in Rzeszow is so threatened by a war conflict that it is being considered moving westwards, to a safer territory. Of course, this could be an opportunity. Otherwise, there is little hope for a fundamental change.

However, any takeover of activities in this area will be largely conditional on the implementation of AS 9100 and Nadcap certification. Those who are not ready for this trend today, and that is only Galvamet from commercial hardening plants, will need at least 2 years to implement the system so that it can be included in the list of approved suppliers. Of course, in the event of a critical situation, it is possible to work on a supplier audit of Snecma, Safran, Solar Turbine, Siemens Energy, etc., but this is only a temporary solution.

Until recently, I thought that PBS jet engines, because they are disposable, would not need anything like this. But the opposite is true. Already today, PBS declares that the drones powered by them must fly further and also have a higher payload, i.e. performance. And reliability? This will certainly be a tough demand, because if drones, missiles do not fly and fall elsewhere, it can have disastrous consequences. So even though PBS still does not require anything special for heat treatment, sooner or later it must come up with this requirement. And without Nadcap, AC7101, AC7102, AMS 2750 or AS 9100, a reliable system cannot be ensured in the hardening plant.

However, this development is also related to the development of HIP (Hot Isostatic Pressing). Until recently, it was a utopia, but today it is a reality. Already 3 HIP production devices from Quintus have been installed or are being installed in CZ, but they will certainly not be the last.

This is also related to the development of precision casting or AM technologies. Those who have bought metal 3D printers and want to produce critical parts will have to accept that it is not possible without HIP. Gradually, the 99.999% printing strategy will end and the era of economic strategy will begin with the subsequent HIP and other thermal post-processes.

It will probably be worse with forgings, where stagnation or decline can be expected. After all, AI sees it as follows:

Source ChatGBT 5.2

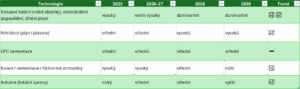

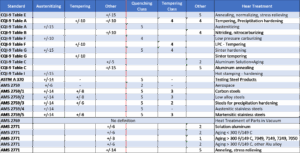

In terms of technology, the growth potential can be seen especially in vacuum. Although it does not look like it from the table, conventional carburizing will gradually decrease, or it will be moved to low-cost countries where there is no such control of the carbon footprint, but the total share of LPC in the heat treatment portfolio will grow more slowly than the volume of traditional ENDO cementation is decreasing. But this may change fundamentally in 2026, depending on how stubborn the EU will be in terms of carbon taxes.

In general, with regard to costs, there will also be a gradual transition to one-step technologies, such as nitriding or carbonitridation, but partly also induction or laser hardening. But this is nothing new. Compared to the past, however, it must be taken into account that the material will not adapt to heat treatment equipment, but on the contrary, these devices will adapt to the material. However, it will also mean a move away from quenching in the gas stream, and a return to hardening in oil or even water. The effort to save on material, especially in serial production, will be the dominant factor with an impact on steel alloying.

Source: ChatGBT 5.2

For powder technologies, the greatest prospect is in Binder Jetting and MIM technology. However, they will only work for critical parts if HIP and high-quality heat treatment are applied after sintering.

Source: ChatGBT 5.2

Although there are many ideas in this area, there is again very little space for commercial hardening plants. Anyone who starts to seriously deal with these AM technologies will want to have everything they need at home. That is, at least sintering, and HIP if it would hinder production as such. An example is Pankl Racing System AG, where pressure on deadlines or maintaining its own know-how forced manufacturers to invest in their own HIP. Not everyone has the nerve to take parts for HIP to Bilbao (E) or Sint Niklaas (B).

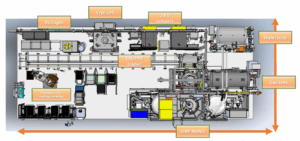

In 2026, however, an increase in automation and robotization can also be expected, as well as digitization. A whole generation of great people is gradually disappearing from the field, and there is nothing and no one to replace it. But this is not just our local problem, it concerns metallurgy worldwide. Hardening plants will therefore need low-cost people to prepare the charge, but everything else should be done automatically. A good example is ALD lines with LPC in Mladá Boleslav and Vrchlabí, as well as ECM in Bosch Jihlava and Poclain Hydraulics in Brno.

In terms of the range of furnaces, the time is coming when it will be necessary to consider whether to continue with classic furnaces under a protective atmosphere or to consider a vacuum. Although innovative solutions are proposed every year, emissions will be crucial. Unfortunately, these cannot be reset with controlled atmospheres. It will therefore be necessary to consider where and how to invest.

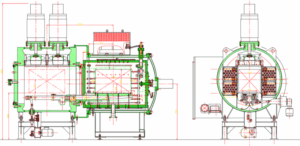

The dimensions of the furnaces will also change. At the vacuum, we are at a crossroads. The typical size of 699 furnaces is small for many applications, switching to 1299 at least, and on the other hand, large, because AM technologies give us printing platforms up to 400×400 mm.

An important parameter is also the choice of the furnace class in terms of temperature uniformity. Even though we have become accustomed to +/-5 C, it is not an obligation. Instructions can be found in the standards below.

However, before buying a device, we also need to make a balance sheet about calibrations. Periodicity for TUS, SAT, for conventional furnaces for the method of validation of carbon potential Cp, for oxygen probes, dew point measurement or infra-analysis of CO2.

However, because there is a requirement for stability of results, reproducibility and repeatability, there will be more and more ECM NANO 600 systems, where the maximum weight of the charge is only 100 kg, but we can carry up to 6 charges of this type in the furnace. The result is the same or even higher productivity with very good reproducibility and process stability. Moreover, with full automation.

Two-chamber and multi-chamber systems will also be added, both because of their greater flexibility and mainly because of their energy consumption. Systems with a permanently heated working chamber are much more efficient in terms of heating than single-chamber systems, where we always start and end at ambient temperature.

But as steel alloying will decrease, there is also a cooling rate factor for these new materials. Thus, there will be an increase in two- and multi-chamber systems with oil hardening. These can be replaced by hardening in helium up to 20 bar, but not in nitrogen. In terms of investments, it must be taken into account that a good washing machine will cost us the same as a full helium recovery. The choice is therefore primarily technological, not financial.

If the core strength requirements are not essential, furnaces with nitrogen stream quenching up to 20 bar can also be considered. It will cloud the cemented layer, but not the core. In addition, there will be a significant dimensional dependence. If we are a general commercial hardening plant, oil hardening is closer to a random and diverse production structure than quenching in a gas stream. This method is more suitable for established production programs with a minimum of variables.

When choosing furnaces, it should be taken into account that quenching furnaces are designed for quenching, not tempering. Tempering in a quenching furnace must be taken as an alternative method, but the preferred solution must be a tempering furnace. If you do not want nitriding in gas at the same time, the tempering furnace should always be with direct heating. Only for gas nitriding processes is a retort furnace a good choice, but it can also be used for tempering. Only the energy consumption will be 30% higher than in the case of a furnace without a retort with direct heating.

If we are not sure about the requirements for tempering and annealing atmospheres, we follow AMS 2759. There we find recommendations for a protective atmosphere depending on the condition of the surface treatment.

An interesting and practical combination is a tempering furnace with LPN (Low Pressure Nitriding). It is a reliable combination of processes, with high usability for tempering, nitriding and carbonitridation.

If we are going to invest in a single-chamber furnace for quenching in a gas stream, at least one tempering furnace of the same dimensions is needed for its proper use. However, the optimal number of tempering furnaces per quenching furnace is two or three tempering furnaces.

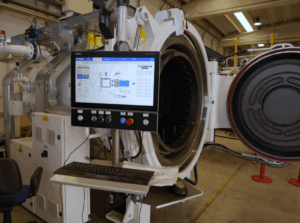

A very important component of the purchase of a furnace are control systems. These should meet the requirements for simple programmability and operability. This is usually offered by SCADA (Supervisory Control And Data Acquisition) systems, which allow the operator to do what you see. If the furnace supplier has its own IT department, you will receive software prepared by it. In that case, any customer modification, usually online, is not a problem.

If the furnace supplier does not have such a department, then the SW will be created by an external company, which may no longer exist in the future. But you need support for 20 years. So you need to choose a system that you and your IT person will have access to in the future.

If you buy a furnace with a DEMIG control system, e.g. DE-CP 300 Series, it is better to buy the Prosys/2 monitoring system right away, you will save yourself the nerves of managing programs on the furnace. And if you don’t know, ask Luboš Klíma, info@elektro-lk.cz.

If you buy a STANGE control system, it will probably be worse with future laickopu management, the system is locked, or only under the manufacturer’s password. So you will have to pay for each SW change.

Already at the time of purchasing the furnace, you must have a balance sheet where you will archive the process data. It is recommended, from the point of view of safety, to store them outside the furnace premises. Enterprise NAS, Cloud or Share Point. Keep in mind that the usual archiving period is 10 years, but it can be longer. But you can also use the cloud storage of the furnace manufacturer, but I would be careful here. The data is yours, not the furnace manufacturer’s, and you need to be sure that it will not be stolen from you.

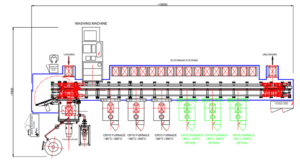

A new trend is to buy entire heat treatment lines. This can mainly supply ALD and ECM. ECM also has an entire ECM Robotics department that can handle any task in robotics.

However, count on the fact that part of the equipment of the line will be equipment from the furnace supplier, the remaining components, such as washing machines, tempering furnaces, robots, cryo furnaces, will be from other suppliers. If you do not want a verified supplier recommended by the furnace manufacturer, you can choose it as you like, but you must wait until the integration of your chosen equipment into the supplier’s line is verified. It’s not just the technical parameters, but above all the software.

When buying, don’t forget to negotiate detailed conditions. Furnace manufacturers categorize some spare parts as consumables that are not covered by the warranty. It’s better to clarify this before you sign anything.

It is also important to agree on the speed of intervention during the warranty period, and its extension by the downtime.

A basic set of spare parts will also come in handy. Here we need to consider how to approach it. The basic criterion for you will be the maximum downtime of the faulty equipment. If you set it, for example, for 1 week, then the spare parts must also be categorized in the same spirit. If these are critical spare parts that mean the furnace malfunctions and at the same time their purchase will be longer than 1 week, you must buy them in stock. For other spare parts, try to get the equipment supplier to play the same game and prepare a list of spare parts for you, including operational availability, and divide them into 3 parts.

- Spare parts available by purchase within 1 week

- Spare parts with a longer delivery time than 1 week to be stored by you

- Spare parts with a longer delivery time than 1 week, which will be stored by the furnace supplier

As for economic calculations, the main equipment is usually depreciated for 20 years (furnaces), secondary ones (washing machines, cryo, etc.) for 10 years. The use of equipment to calculate the return on investment is calculated at 80% of the 8760 Nh for new equipment, and 70% for second-hand equipment. Include maintenance costs in the calculation, which are usually 3% of the purchase price, including the wages of maintenance workers.

Most furnace suppliers will calculate the direct cost of the process for you, they do not take into account, and cannot take into account, your overhead costs. They can fundamentally change the calculation, so it’s up to you. Do not rely on the calculations of the equipment supplier. Don’t use a single overhead factor per operation, but rather divide these overheads into 3 categories: labour, assets and floorspace.

So that’s all the advice for the journey to 2026. It will not be easy for commercial hardening plants. The outer world is unstable, and this is also reflected in our inner world, in the commercial hardening plant. When I think back to recent history, nothing major is actually happening compared to the crisis in 2009, when our turnover went down by 60%. From this point of view, these are now only minor fluctuations without catastrophic consequences.

And how will it turn out? We will see that at the end of the year. I wish you all the best and especially strong nerves.

Jiří Stanislav

January 6, 2026